The 'Compliance Station®︎ Series' resolves the challenges of risk assessment faced by our customers.

Many financial institutions face challenges in risk assessment due to insufficient acquisition and organization of customer data. CDL addresses these challenges in risk assessment through the Compliance Data Management Platform, the 'Compliance Station®︎ Series'.

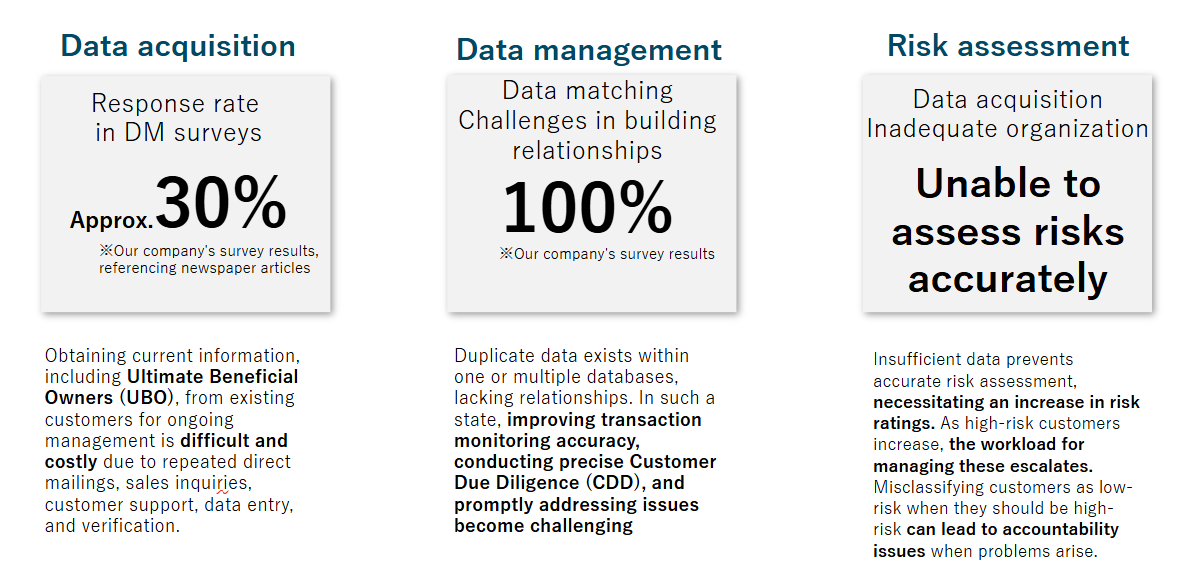

The challenges of risk assessment faced by our customers

Many financial institutions face challenges in risk assessment due to insufficient acquisition and organization of customer data.

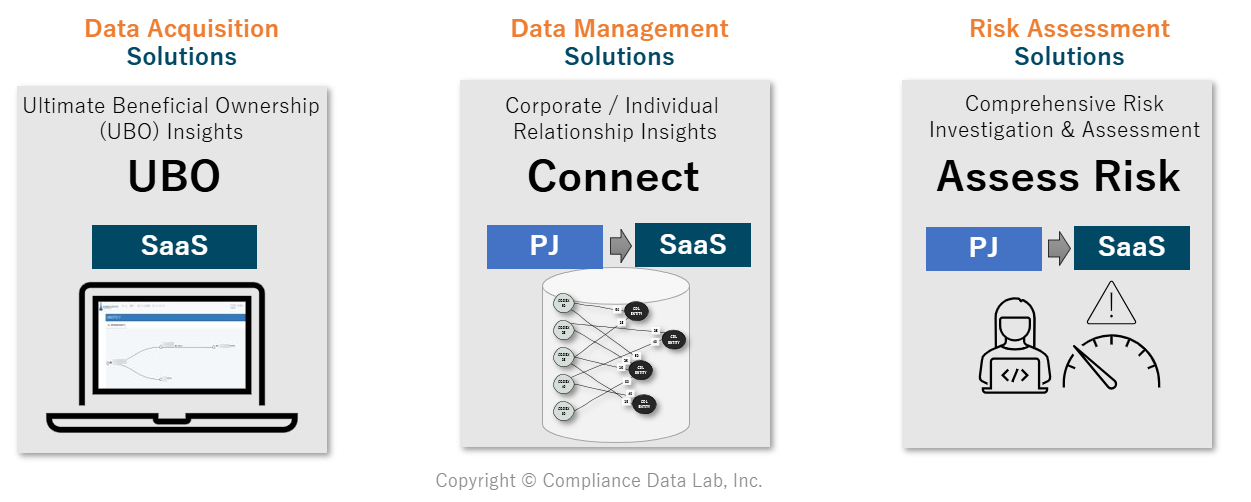

The solution provided by CDL

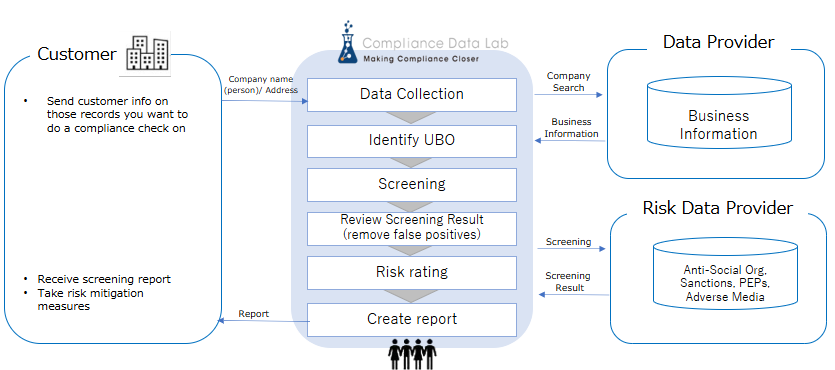

CDL provides services to address the challenges of data acquisition, organization, and risk assessment. These services aim to enhance measures against money laundering, terrorism financing, and other related issues.

Compliance Data Management Platform

「Compliance Station®︎ Series」

コンプライアンス・

ステーション®︎シリーズ

効率的効果的カスタマー・デュー・デリジェンスを実現するため、顧客データの取得・整備からリスクの評価までご支援します。

.webp)

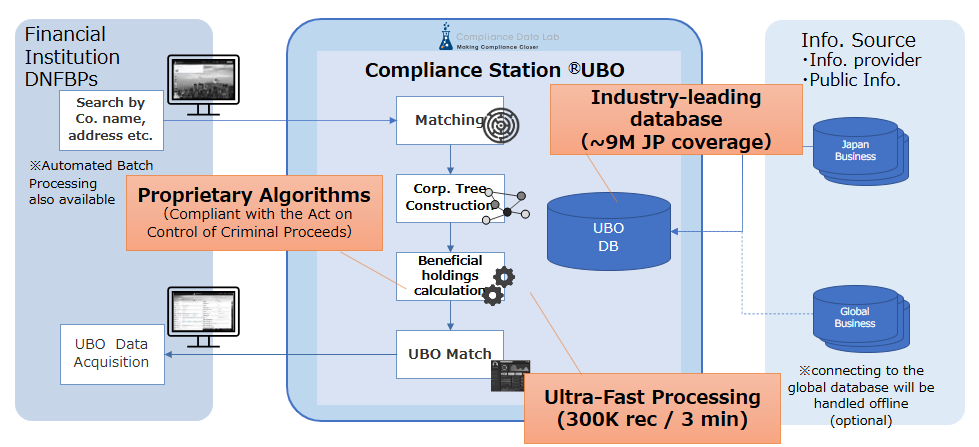

Compliance Station®️ UBO

We provide Ultimate Beneficial Owner (UBO) information identified in accordance with anti-money laundering laws based on information from corporate information providers.

In addition to our offline bulk UBO information provision service, we are currently developing a system to instantly provide UBO information online.

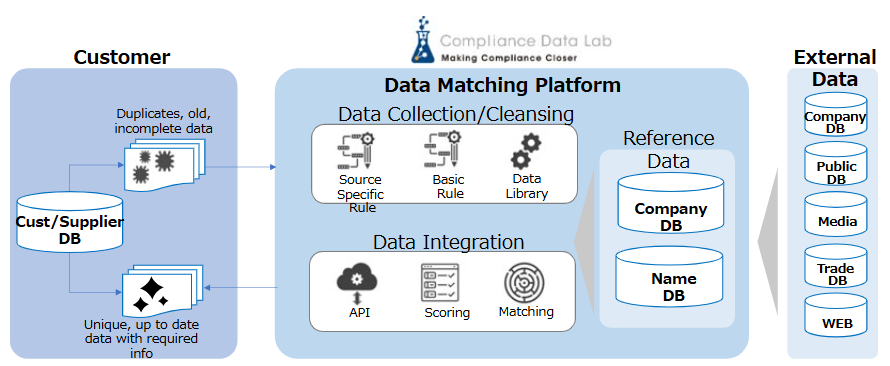

Compliance Station®Connect

Our team, comprised of members with experience in building and managing global databases at D&B, conducts data normalization to reconcile disparate data managed across business units and addresses duplicates and missing information within the same database. We provide deduplicated, up-to-date data with all necessary information consolidated.

Compliance Station®️ Risk Assessment

We undertake complex compliance management tasks on behalf of our clients. Our experienced team members handle tasks such as gathering corporate information, identifying Ultimate Beneficial Owners (UBOs), and conducting compliance checks on entities (both corporate and individual) involved.