Achieve Continuous Customer Management

with Reliable Corporate Information,

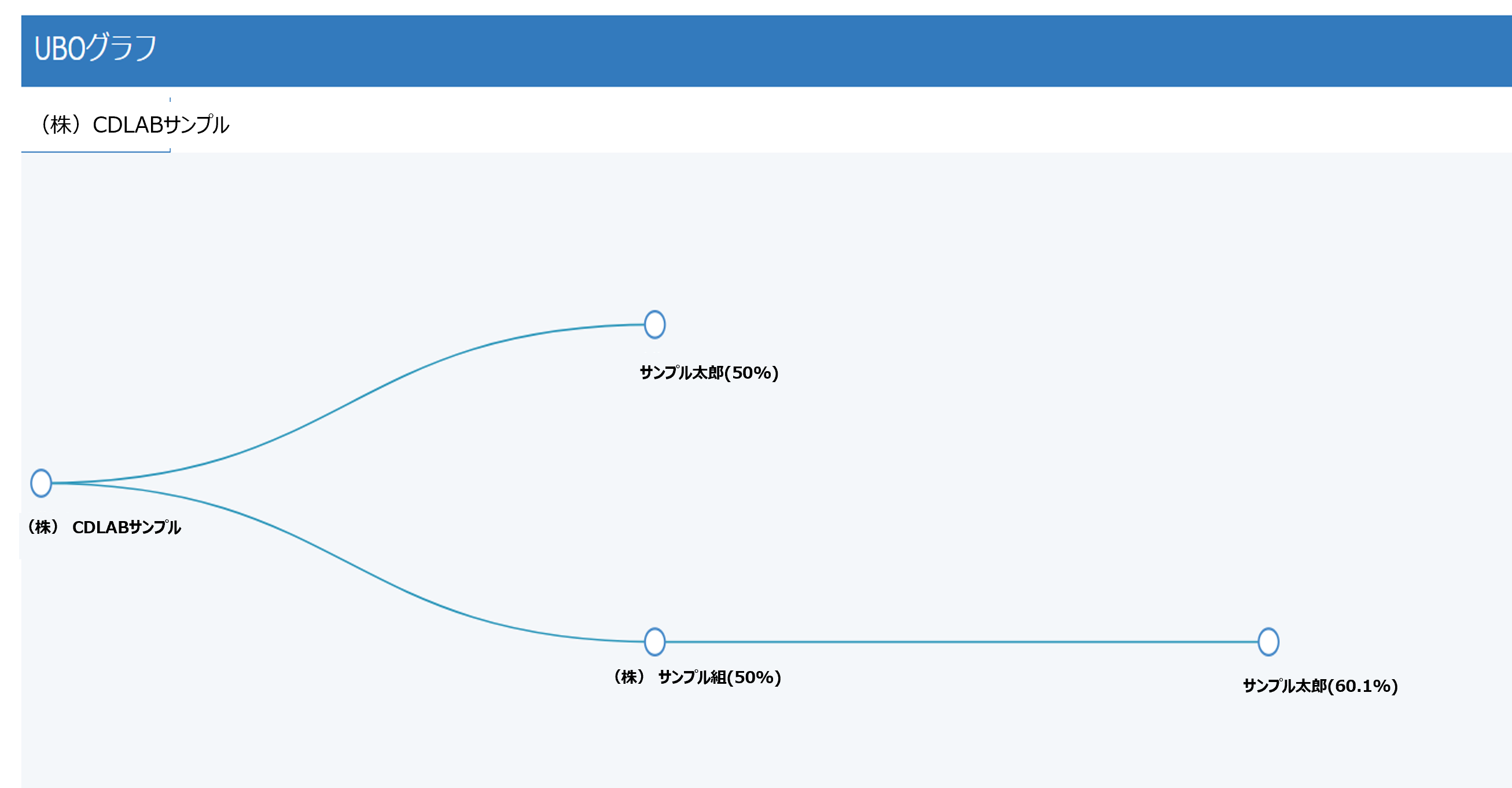

Including UBO(Ultimate Beneficial Owner) Data

Making Compliance Closer

Case Studies

MS&AD Insurance Group Holdings, Inc.

Get Instant Access to Ultimate Beneficial Ownership Information

Streamline Your Due Diligence with Our Intuitive Batch & UI/UX Platform

The Shiba Shinkin Bank

Increase the collection rate of beneficial ownership information from 40% to 90%

- Balancing AML strengthening with operational efficiency, creating an environment where branches can focus on customer service -

Challenges in continuous customer management for financial institutions.

1. Inefficient and ineffective data collection

Many financial institutions depend on traditional methods like direct mail for customer management, resulting in data collection rates of only 20-30%. This leads to incomplete or inaccurate data, affecting customer service quality.

Additionally, these traditional methods struggle with real-time data collection, delaying the detection of changes in customer situations and risks. This makes it difficult to identify potential issues early, negatively impacting risk management and customer satisfaction. In today's environment, where data accuracy and timely collection are essential, the limitations of traditional methods are becoming increasingly apparent.

2. Resource Shortages in Financial Crime Prevention

Many companies face resource shortages in financial crime prevention. This is particularly true for financial institutions and large organizations, where the processes of data collection, analysis, and monitoring are crucial to comply with complex regulations. However, reliance on limited financial and human resources increases the risk that these processes are not implemented effectively.

This resource shortage can lead to a lack of data accuracy and completeness, resulting in an increased risk of compliance violations. Furthermore, without efficient data collection methods, companies may have to rely on traditional approaches (such as direct mail or manual data entry). These are not only inefficient and costly, but can also degrade the quality of customer interactions and heighten legal risks.

To address this situation, it is essential to implement more effective and efficient data management practices, along with adequate resource allocation. Recognizing the importance of compliance, we must take concrete steps to resolve resource shortages.

3. The complexity of managing duplicate data within the organization and its solutions

Many companies face issues with duplicates and inconsistencies in managing their data. Information collected from multiple data sources and systems often lacks consistency, leading to the same entity or branch being recorded in different ways. Such data discrepancies not only reduce the efficiency of business processes but also increase risks in decision-making.

Specifically, one method of money laundering known as structuring involves breaking transactions into smaller amounts to avoid detection. Without proper entity consolidation, it becomes difficult to identify this tactic.

Additionally, the data often contains information about defunct companies or outdated details which further undermines its reliability. Such a situation can lead to inefficiencies and misjudgments in marketing activities, customer management, and business strategy development.

The time and effort required for data management is increasing, making it a significant burden for companies to maintain accurate and consistent data. As a result, this can hinder business growth and pose a risk to competitiveness.

Benefits of implementing CDL's solutions

NEWS

2025年6月25日【展示会出展のお知らせ】

2025年7月2日(水)〜4日(金)に京都で開催されるスタートアップカンファレンス「IVS2025」の展示交流イベント「IVS Startup Market」へ出展いたします。

2025年6月5日【記事掲載のお知らせ】

ニッキンONLINEで「コンプライアンス・ステーション®UBOモニタリング」リリースのニュースが紹介されました。

2025年6月5日【記事掲載のお知らせ】

日経新聞電子版で「コンプライアンス・ステーション®UBOモニタリング」リリースのニュースが紹介されました。

2025年6月5日【プレスリリース】

取引先法人の重要な変化を適時把握できる新機能「コンプライアンス・ステーション®UBOモニタリング」をリリースしました。

2025年5月30日【プレスリリース】

ひまわり信用金庫に「コンプライアンス・ステーション®UBO」を導入していただきました。

2025年4月24日【プレスリリース】

愛媛銀行に「コンプライアンス・ステーション®UBO」を導入していただきました。

2025年4月11日【プレスリリース】

「コンプライアンス・ステーション®リスク評価」が「令和7年度 東京都トライアル発注認定制度」に認定されました。

2025年4月8日【記事掲載のお知らせ】

日経新聞電子版で弊社の資金調達のニュースが紹介されました。

2025年4月8日【プレスリリース】

ニッセイ・キャピタル株式会社をリード投資家として、第三者割当増資により2億円の資金調達を実施しました。

CDL Blog Subscription

Specialists in data management compliance along with experts from both domestic and international backgrounds, including Hiroshi Yamazaki, CEO of CDL, provide insights into the latest domestic and international compliance-related information, trends, and critical issues. Through this newsletter, we also offer information on the latest best practices and guidelines.

For those interested in subscribing to the newsletter, simply click the link below and fill out the required information on the form to register. Subscription is free of charge.

-1.png)

-1.png)